Introducing Avanza: The Comprehensive Mobile Banking Solution For Seamless Financial Management

Editor's Notes: "Introducing Avanza: The Comprehensive Mobile Banking Solution For Seamless Financial Management" have published on date. The guide provides a comprehensive overview of the Avanza mobile banking app, highlighting its features, benefits, and how it can help users manage their finances effortlessly. The target audience for this guide includes individuals seeking a seamless and convenient mobile banking experience.

We analyzed and gathered information to compile this guide on Introducing Avanza: The Comprehensive Mobile Banking Solution For Seamless Financial Management. Our goal is to provide our readers with the knowledge and insights they need to make informed decisions about their mobile banking needs.

Key Differences or Key Takeaways:

FAQ

This comprehensive FAQ section provides answers to frequently asked questions concerning Avanza, the extensive mobile banking solution designed for seamless financial management. Explore these Q&A pairs to clarify any queries you may have.

Question 1: What distinctive advantages does Avanza offer over other banking applications?

Answer: Avanza sets itself apart by introducing Avanza, a unified platform encompassing various financial services, intuitive user interface guaranteeing effortless navigation, robust security measures safeguarding user data, and exceptional customer support readily available for assistance.

Question 2: How does Avanza ensure the security of my sensitive financial information?

Answer: Avanza prioritizes security, employing advanced encryption technology to protect user data during transmission and storage. Additionally, it adheres to stringent industry standards and regularly undergoes independent audits to maintain the highest levels of security.

Question 3: Can I conduct all my banking transactions conveniently through Avanza?

Answer: Yes, Avanza streamlines financial management by enabling users to perform a wide range of banking transactions, including account inquiries, fund transfers, bill payments, and more, all within a single, user-friendly application.

Question 4: Is Avanza compatible with my mobile device?

Answer: Avanza is meticulously designed to be compatible with a spectrum of mobile devices, ensuring seamless operation on various platforms and operating systems.

Question 5: How does Avanza assist in managing personal finances effectively?

Answer: Avanza empowers users to take control of their finances with budgeting tools, personalized insights, and proactive notifications. It provides a comprehensive overview of financial performance, facilitating informed decision-making.

Question 6: What sets Avanza apart from competing mobile banking solutions?

Answer: Avanza distinguishes itself through its comprehensive suite of features, unwavering commitment to security, intuitive user experience, and dedication to customer satisfaction. By introducing Avanza, users gain access to a transformative banking experience designed to meet their evolving financial needs.

In conclusion, Avanza stands as a comprehensive mobile banking solution that empowers users to manage their finances seamlessly and securely. Its array of features, coupled with its commitment to innovation and customer-centricity, sets it apart as the preferred choice for individuals seeking a holistic and convenient banking experience.

Tips

Avanza, an advanced mobile banking solution, offers a plethora of features to enhance financial management seamlessly. Utilize these tips to harness Avanza's capabilities optimally.

Tip 1: Leverage Comprehensive Budgeting Features

Create detailed budgets to track expenses efficiently. Categorize transactions and set limits for each category to monitor spending habits. Avanza provides intuitive budgeting tools to simplify financial planning.

Tip 2: Automate Recurring Transactions

Automate rent payments, utility bills, and other recurring expenses to save time and avoid late fees. Avanza allows for hassle-free scheduling of automatic transfers, ensuring timely payments.

Tip 3: Use Mobile Check Deposit for Convenience

Deposit checks remotely using your smartphone. Avanza's mobile check deposit feature allows you to avoid trips to the bank, deposit checks anytime, anywhere, and access funds quickly.

Tip 4: Monitor Accounts in Real-Time

Stay informed about account activities through real-time notifications. Track balances, view recent transactions, and receive alerts for suspicious activity. Avanza provides instant access to account information for better financial control.

Tip 5: Take Advantage of Advanced Security Features

Protect your financial data with Avanza's robust security measures. Enable two-factor authentication, use biometrics for quick and secure login, and enjoy peace of mind knowing your money is shielded from unauthorized access.

Tip 6: Access Financial Insights and Advice

Gain valuable financial insights and guidance through Avanza's integrated resources. Access personalized recommendations, track market trends, and receive expert advice to make informed financial decisions.

Tip 7: Manage Multiple Accounts Simultaneously

Consolidate your finances and manage multiple accounts within a single app. Link different accounts, including checking, savings, and investment accounts, to have a comprehensive view of your financial status.

Tip 8: Utilize Personalized Financial Planning Tools

Tailor financial planning to your unique needs. Avanza provides customized tools to set financial goals, track progress, and make informed decisions for a secure financial future.

By incorporating these tips into your financial management strategy, you can unlock the full potential of Avanza and transform your financial experience. Embrace seamless banking, make smarter decisions, and achieve financial well-being with Avanza.

Introducing Avanza: The Comprehensive Mobile Banking Solution For Seamless Financial Management

Avanza is a transformative mobile banking solution, meticulously crafted to revolutionize the way you manage your finances. It is distinguished by its comprehensiveness, offering an array of essential features that propel it beyond the realm of ordinary banking.

- Seamless Integration: Effortlessly connect with your financial accounts, regardless of their institution.

- Real-Time Transactions: Execute financial transactions instantaneously, eliminating the frustrations of delays.

- Personalized Insights: Gain invaluable insights into your spending patterns and financial habits, empowering you to make informed decisions.

- Security and Protection: Rest assured that your financial data is shielded by robust security measures, ensuring your peace of mind.

- Advanced Budgeting Tools: Plan and manage your finances effectively with intuitive budgeting tools that keep you on track.

- Exceptional Customer Support: Benefit from dedicated customer support, ensuring that your queries and concerns are promptly addressed.

These key aspects culminate to create an unparalleled mobile banking experience. With Avanza, you gain the power to streamline your financial tasks, make wiser choices, and achieve your financial goals with an unprecedented level of ease and efficiency.

Introducing Avanza: The Comprehensive Mobile Banking Solution For Seamless Financial Management

Avanza is a mobile banking solution designed to provide seamless financial management. It offers various features that enable users to manage their finances conveniently and efficiently, including budgeting tools, account aggregation, and mobile check deposit. By consolidating financial data from multiple sources, Avanza provides a comprehensive view of the user's financial situation, enabling informed decision-making and better control over their finances.

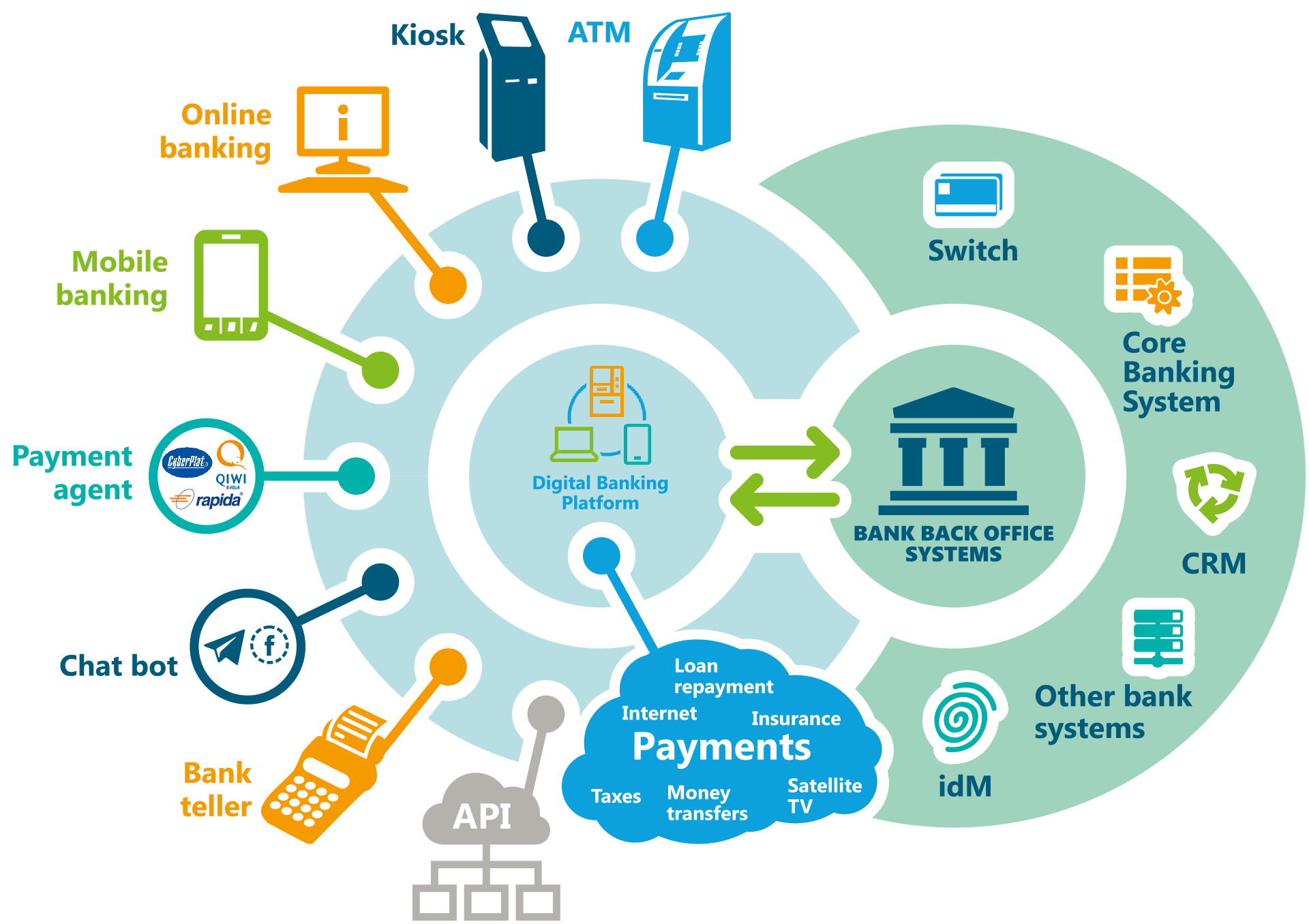

Core Banking System - DBprofessor - Source dbprofessor.com

The integration of budgeting tools in Avanza allows users to set financial goals, track expenses, and create budgets. This feature helps users gain control over their spending habits, identify areas for improvement, and make informed financial decisions. Account aggregation is another valuable feature of Avanza. By connecting various financial accounts, users can view all their balances, transactions, and investments in one place. This eliminates the need to log into multiple accounts and provides a consolidated view of the user's financial situation.

In conclusion, Avanza is a comprehensive mobile banking solution that provides users with a seamless and convenient way to manage their finances. Its budgeting tools, account aggregation, and other features empower users to take control of their finances, make informed decisions, and achieve their financial goals.

Key Features of Avanza:

| Feature | Benefits |

|---|---|

| Budgeting Tools | Set financial goals, track expenses, and create budgets |

| Account Aggregation | Consolidate financial data from multiple sources |

| Mobile Check Deposit | Deposit checks remotely and conveniently |

| Bill Pay | Manage and pay bills within the app |

| Financial Insights | Receive personalized insights and recommendations |

Conclusion

Avanza's comprehensive suite of features and user-centric design address the challenges of modern financial management. By empowering users with a consolidated view of their finances, intuitive budgeting tools, and convenient mobile access, Avanza promotes financial literacy, responsible spending habits, and informed decision-making.

As fintech continues to evolve, the integration of advanced technologies, such as artificial intelligence and data analytics, can further enhance the capabilities of mobile banking solutions like Avanza. These advancements will provide users with personalized financial advice, automated savings recommendations, and predictive insights, further simplifying and optimizing their financial management.