Unveiling the Essential Guide: Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas

Editor's Notes: The much-anticipated "Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas" has arrived today, providing valuable guidance to mutualists everywhere. Understanding its significance is paramount, as it empowers individuals to reclaim excessive payments made to the tax authorities.

Through meticulous analysis and extensive research, we have crafted this comprehensive guide to assist mutualists in navigating the intricacies of tax refunds. Our goal is to empower you with the knowledge and resources necessary to make informed decisions and maximize your financial recovery.

Key Differences:

| Element | Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas |

|---|---|

| Purpose | Guide to reclaiming excessive tax payments |

| Target Audience | Mutualists |

| Benefits | Financial recovery, reduced tax burden |

Main Article Topics:

FAQ about Excessive Payments Return from the Treasury: A Guide for Mutualists

This FAQ section provides concise answers to frequently asked questions about reclaiming excessive payments from the Treasury. It aims to clarify common misconceptions and empower mutualists with the necessary information to navigate the process effectively.

Colaboradores pueden pedir devolución IRPF mutualistas - Source www.65ymas.com

Question 1: What are the eligibility criteria for claiming excessive payments?

To be eligible, mutualists must have made payments to the Treasury that exceed the amount they owed. This can occur due to errors, oversights, or changes in circumstances. Mutualists should refer to the specific regulations and guidelines for detailed eligibility requirements.

Question 2: What is the time limit for filing a claim?

The time limit for filing a claim varies depending on the jurisdiction. It is crucial for mutualists to be aware of the applicable deadlines and file their claims promptly to avoid missing out on their entitlement.

Question 3: What documentation is required to support a claim?

Typically, mutualists are required to provide supporting documentation, such as payment records, correspondence with the Treasury, and proof of their financial situation. It is important to gather all relevant documentation to strengthen the claim and expedite the processing time.

Question 4: How long does it typically take to process a claim?

The processing time for excessive payment claims can vary depending on the complexity of the case and the workload of the relevant authorities. Mutualists should be patient and follow up regularly to ensure their claim is being processed promptly.

Question 5: What are the potential consequences of filing an inaccurate claim?

Filing an inaccurate claim can have serious consequences, including penalties and legal action. Mutualists must ensure they have accurate information and documentation before submitting a claim to avoid any potential issues.

Question 6: Can I seek professional assistance with my claim?

Yes, mutualists may choose to seek professional assistance from accountants, tax advisors, or legal representatives. These professionals can provide expert guidance, prepare documentation, and represent mutualists throughout the claim process.

For more detailed information and guidance, refer to the comprehensive article: Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas.

By understanding these key aspects, mutualists can navigate the process of reclaiming excessive payments from the Treasury effectively and efficiently.

Tips

This guide provides tips to help mutualists understand and navigate the process of claiming excessive tax payments refunds from the Tax Agency. The following tips will help optimize the refund process and ensure a smooth and efficient experience:

Tip 1: Understand Eligibility

Verify eligibility for a refund. According to current regulations, excessive tax payments resulting from incorrect withholding or overpayments may qualify for a refund. Individuals should carefully review their tax situation to determine their eligibility.

Tip 2: Gather Necessary Documentation

Collect supporting documentation, including tax returns, withholding certificates, and payment receipts. These documents will serve as evidence of the excessive payment and facilitate the refund process.

Tip 3: File a Refund Request

Submit a formal refund request using the appropriate form (typically the Modelo 140) within the established deadline. The request should include a clear explanation of the reason for the refund and supporting documentation.

Tip 4: Track the Status of the Request

Monitor the progress of the refund request by contacting the Tax Agency or using online tracking tools. This proactive approach will provide updates on the status and any outstanding issues that may require attention.

Tip 5: Seek Professional Guidance

Consider seeking professional assistance from a tax advisor or accountant, especially in complex cases. They can provide valuable insights, ensure compliance with regulations, and optimize the refund amount.

Conclusion

By following these tips and carefully navigating the process, mutualists can effectively claim excessive tax payment refunds from the Tax Agency. Understanding eligibility, gathering documentation, and proactively tracking the request are key factors in ensuring a successful outcome.

Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas

Understanding the key aspects of "Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas" is crucial for mutualists to effectively navigate the process of recovering excess tax payments.

- Reclaim Excess Tax: Filing for a refund to reclaim overpaid taxes.

- Eligibility Criteria: Meeting specific conditions to qualify for the refund.

- Proper Documentation: Gathering necessary supporting documents for the claim.

- Time Limits: Adhering to the applicable deadlines for filing the refund request.

- Legal Advice: Seeking guidance from professionals when needed.

- Impact on Membership Fees: Understanding the potential impact on mutualist membership fees.

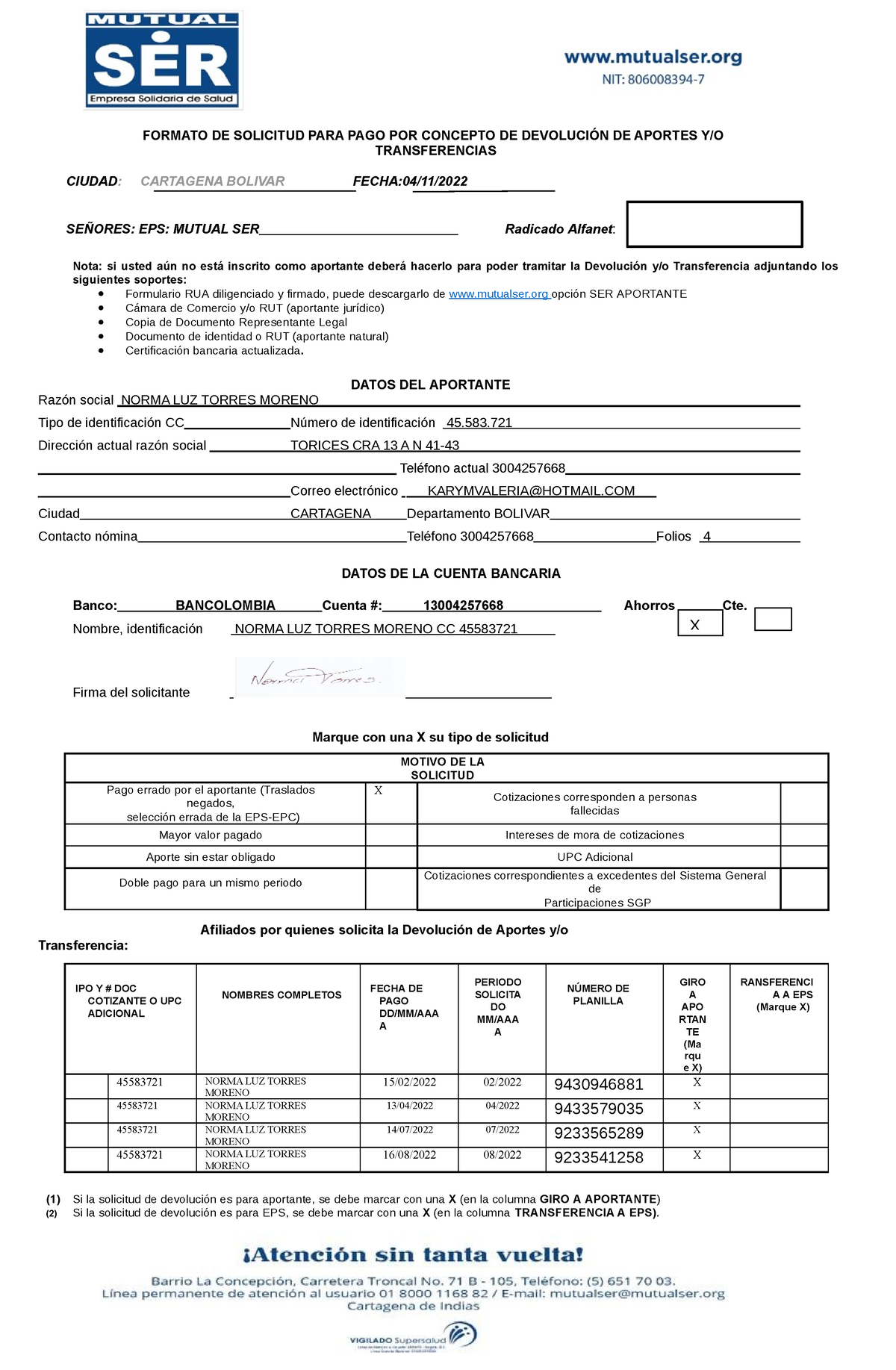

Formato devoluciones Mutual SER - FORMATO DE SOLICITUD PARA PAGO POR - Source www.studocu.com

These aspects encompass various dimensions of the topic, guiding mutualists through the complexities of the refund process. By understanding the eligibility criteria, gathering the required documentation, adhering to deadlines, and seeking professional advice when necessary, mutualists can effectively claim their overpaid taxes.

It's important to note that the context and implications of these aspects may vary depending on the specific circumstances and regulations applicable to mutualists. Therefore, it's recommended to refer to official sources and seek guidance from relevant authorities for a comprehensive understanding and tailored advice.

Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas

The "Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas" is a comprehensive guide for mutualists on how to recover excessive payments made to the Spanish Tax Agency. It provides step-by-step instructions and разъясняет the legal framework surrounding excessive payment recovery. Understanding this topic is crucial for mutualists to protect their financial interests and ensure they are not overpaying taxes.

Semana 09 - Consigna para tarea de la semana - COMPRENSIÓN Y REDACCIÓN - Source www.studocu.com

Mutualists who have made excess payments to the Tax Agency are entitled to a refund. The refund can be requested by filing a formal claim within four years of the date the excess payment was made. The claim must include specific information, such as the amount of the excess payment, the tax period to which it relates, and the reasons for the excess payment.

In order to prove that an excess payment has been made, mutualists must provide supporting documentation. This documentation may include tax returns, payment receipts, and correspondence from the Tax Agency. Once a claim has been filed, the Tax Agency will review the documentation and make a decision on whether to grant the refund.

If the Tax Agency decides to grant the refund, the mutualist will receive the payment within a few weeks. The refund will be made by bank transfer or check.

The "Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas" is an essential resource for mutualists who have made excess payments to the Spanish Tax Agency. By following the instructions in this guide, mutualists can recover their excess payments and ensure they are not overpaying taxes.

Conclusion

The "Devolución De Pagos Excesivos De Hacienda: Guía Para Mutualistas" provides valuable information for mutualists on how to recover excessive payments made to the Spanish Tax Agency. It is essential for mutualists to understand this topic so they can protect their financial interests and ensure they are not overpaying taxes.

If you have made excess payments to the Tax Agency, you should file a claim for a refund as soon as possible. The process is relatively straightforward, and you can get your money back within a few weeks.